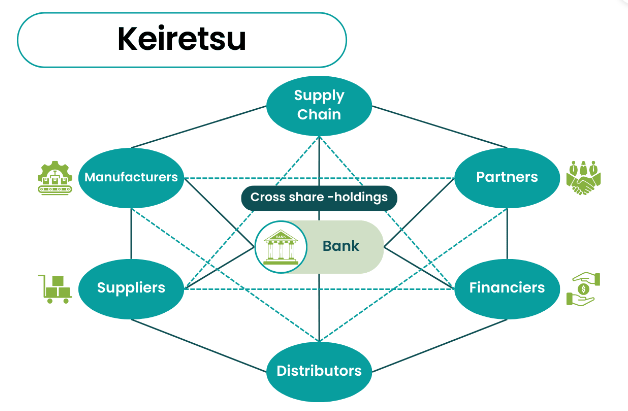

Imagine a group of companies that are more like close-knit friends than mere business partners. That’s the essence of a keiretsu. This Japanese term describes a network of companies that are bound together through mutual business interests and shareholdings. Let’s dive into how this intriguing system came to be and how it works in the world of business and finance.

The concept of keiretsu has roots in the pre-WWII Japanese business world, dominated by zaibatsu—massive family-controlled conglomerates like Mitsubishi and Sumitomo. These zaibatsu controlled a range of industries and were a staple of the Japanese economy. Post WWII, the allied occupation forces dismantled this Zaibatsu encourage competition and to eliminate monopolistic practices by companies. This led to origination of Keiretsu which reshaped how companies in Japan are connected and operated. This also helped the companies to mutually benefit and sped up post war recovery tasks and economic progress.

[Images: Google]

Types of Keiretsu

Horizontal Keiretsu: Picture a web of companies from various industries that hold shares in each other’s businesses. This kind of keiretsu is like a giant family reunion where everyone supports one another.

Vertical Keiretsu: Here, think of a supply chain where a leading company (like a major manufacturer) is surrounded by a network of suppliers and distributors. Toyota’s intricate web of suppliers and partners is a prime example of this type.

Example: The “Big Six” which includes DKB Group, Mitsui, Mitsubishi, Sumitomo, Fuyo and Sanwa.

Key Benefits of having Keiretsu Model of Collaboration

Operational:

Stability and Loyalty: The keiretsu network offers a sense of security and loyalty. Companies can rely on each other, which helps in times of economic uncertainty.

Efficient Operations: In vertical keiretsu, the close relationships between manufacturers and suppliers lead to smoother operations and higher efficiency in the supply chain.

Financial:

Cross-Shareholding Impact: Owning shares in each other’s businesses protects companies from market volatility and hostile takeovers. But it can also limit liquidity and market efficiency.

Capital Access: Being part of a keiretsu can make it easier for companies to get loans and investments. Financial institutions are often more willing to support companies that are part of a trusted network.

Risk Management: The interconnected nature of keiretsu spreads risk across the network. While this can provide a cushion, problems in one company can ripple through the group.

Today, keiretsu still influences Japanese business, but it’s evolving. As global markets change and companies seek new ways to compete, some keiretsu are adapting and forming new types of alliances. Yet, the fundamental idea of mutual support and collaborative strength remains a cornerstone of their strategy.

In short, keiretsu is like a dynamic business club where members have each other’s backs, fostering stability and cooperation in the fast-paced world of commerce.

India has several business groups with similarities to the Japanese keiretsu system, though they may not be exact replicas. In India, these conglomerates often operate through a network of companies linked by family ownership, cross-shareholding, or long-term business relationships, Like the Reliance & Tata Group for example.