Indian Stock Market Manipulation - Do you feel weird movements in markets while taking trades?!

I happened to read an article about Market Manipulation happening in Indian Stock Markets. I had a feeling that this might be happening for some time now as "unexplained market movements" are quite common now a days. Below I have tried to produce a simplified version of the article for the benefit of my readers.

A foreign hedge fund, referred to as "the manipulator", is alleged to be using its deep pockets and sophisticated trading strategies to orchestrate wild swings in the market indices and generate substantial profits, seemingly at the expense of other traders. This manipulation involves both “violent” expiries, where the index is moved sharply, and “quiet” expiries where the index is kept in a narrow band, impacting the implied volatility of options and rendering many contracts worthless for those who don’t understand the market being rigged. These actions raise serious concerns about market integrity and the vulnerability of individual traders.

2. Key Findings and Themes

Market Manipulation: The core issue is the alleged manipulation of the Nifty and Sensex indices on weekly options expiry days. The manipulator is accused of using large trades to move the indices, creating conditions for profitable option trades at the expense of others.

"Since April, there have been multiple instances of inexplicable moves in the stock-market indices on weekly options expiry days."

"The manipulator follows a pattern of “violent” and “quiet” expiries in reaping profits while other traders try to decode the former’s moves"

The Manipulator: An unidentified foreign hedge fund is considered to be behind the alleged manipulation. This entity is described as having "deep pockets" and advanced trading expertise, enabling them to execute these complex strategies.

“The biggest winner that day was most likely a foreign hedge fund, a master manipulator,” according to an options trader.

Modus Operandi: The manipulator’s methods are described as a combination of deception and unpredictability, and include:

“Violent Expire”:Pre-positioning massive sizes in options on expiry day.

Moving the market by buying or selling its constituents to generate huge profits.

The “steep move in indices towards the end of the day” leads to “the options [being] bought at – and the manipulator laughs all the way to the bank”.

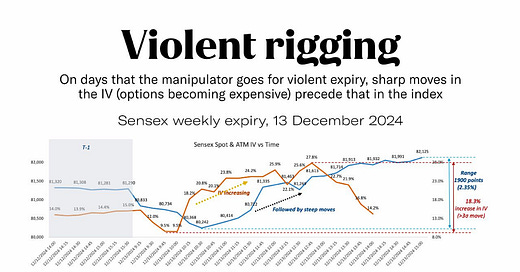

On December 13th, the manipulator created a "violent expiry" by buying options and then moving the market sharply upwards on the expiry date. This led to huge profits on those call options.

“Quiet Expire”:

The manipulator sells options contracts on expiry days and then “keeps the indices within a very tight range by buying or selling the index constituents as need be”.

This allows the manipulator to pocket the premiums paid for those options, as the indexes never move above or below the strike price.

"They know beforehand the direction in which the index is going to move. Simply because they are going to create the move," a third trader explained.

Impact on Implied Volatility (IV): The article emphasizes the manipulation of implied volatility in options trading.

The manipulation “reaks of manipulation”, as the “IV move now precedes those in the indices,” while ideally, the index moves influence option prices.

During violent expiries, IV spikes substantially, which is described as “unnatural”.

During quiet expiries, the implied volatility falls to “bizarre low levels”.

"All natural statistics-based estimates, which should ideally dictate option pricing, have been thrown out of the window,"

Impact on Traders:

Individual futures and options traders (F&O) are the most impacted by manipulation, having suffered significant losses.

"More than 9 out of 10 individual futures-and-options (F&O) traders suffered losses... The regulator estimates cumulative losses to the tune of over Rs 1.8 lakh crore for more than 11 million individual traders in this period."

Long-term investors are also negatively affected by the artificially inflated or deflated values in the market.

Regulatory Concerns:

The Securities and Exchange Board of India (Sebi) is aware of the issue and is being pressured to act and to curb the manipulation of the market.

"The wild market swing on 13 December not just raised among some media experts but even prompted the regulator to weigh in."

The article questions whether the regulator is able to effectively curb market manipulation, despite its past interventions to curb exponential F&O growth.

“While Sebi has curbed the exponential F&O trade growth in the past, can it act now to stop the manipulator from toying with the market?”

Profitability: The alleged manipulator is making substantial profits through both “violent” and “quiet” expiry scenarios, while other traders are losing money.

One trader estimated “the manipulator to have been making a profit of about Rs 500 crore (US$58 million) a week, or Rs 25,000 crore a year”.

3. Key Quotes

“The manipulator is making a mockery of the Indian financial markets by toying with its indices with impunity”

"If someone can casually move the Nifty by as much as 2% at his discretion, he is nothing short of God in the market,"

“There are tell-tale markers of an orchestrated set-up.”

“I've not seen anything like this (the swing in implied volatility) in my many years of trading,”

"They know beforehand the direction in which the index is going to move. Simply because they are going to create the move,”

“Pouring a few thousand crore rupees—about Rs 4,000 crore in the cash market—to achieve their goals and pocket tidy profits is not such a big deal for foreign hedge funds that deal in the options market,”

4. Implications

Loss of Investor Confidence: The reported manipulation erodes trust in the Indian stock market and undermines its fairness and integrity.

Need for Stronger Regulation: The article highlights the importance of proactive and effective regulatory measures to detect and prevent market manipulation.

Risk for Small Investors: Individual traders are the most vulnerable to such schemes and may be driven away from the market, causing problems for the market ecosystem as a whole.

"The small fish that the regulator seems keen to protect— individual options traders—might be the most vulnerable in this game."

5. Next Steps

Monitor Sebi's response to the allegations and any regulatory actions taken.

Further investigate the manipulator's identity and trading patterns.

Assess the broader implications for the Indian financial markets and its reputation as an investment destination.

6. Conclusion

This article presents a compelling case for significant market manipulation in the Indian stock options market. The allegations are serious and warrant immediate attention from regulators and market participants. The use of large-scale, deceptive trading practices by a foreign hedge fund risks undermining investor confidence, damaging market integrity and causing substantial losses for small investors. It is crucial that regulatory bodies take swift and decisive action to address this issue.

Credits: Original Article